san antonio tax rate 2021

There is no applicable county tax. Road and Flood Control Fund.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

City of San Antonio Property Taxes are billed and collected by the Bexar County.

. 48 rows Find the local property tax rates for San Antonio area cities towns school districts. Rates will vary and will be posted upon arrival. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

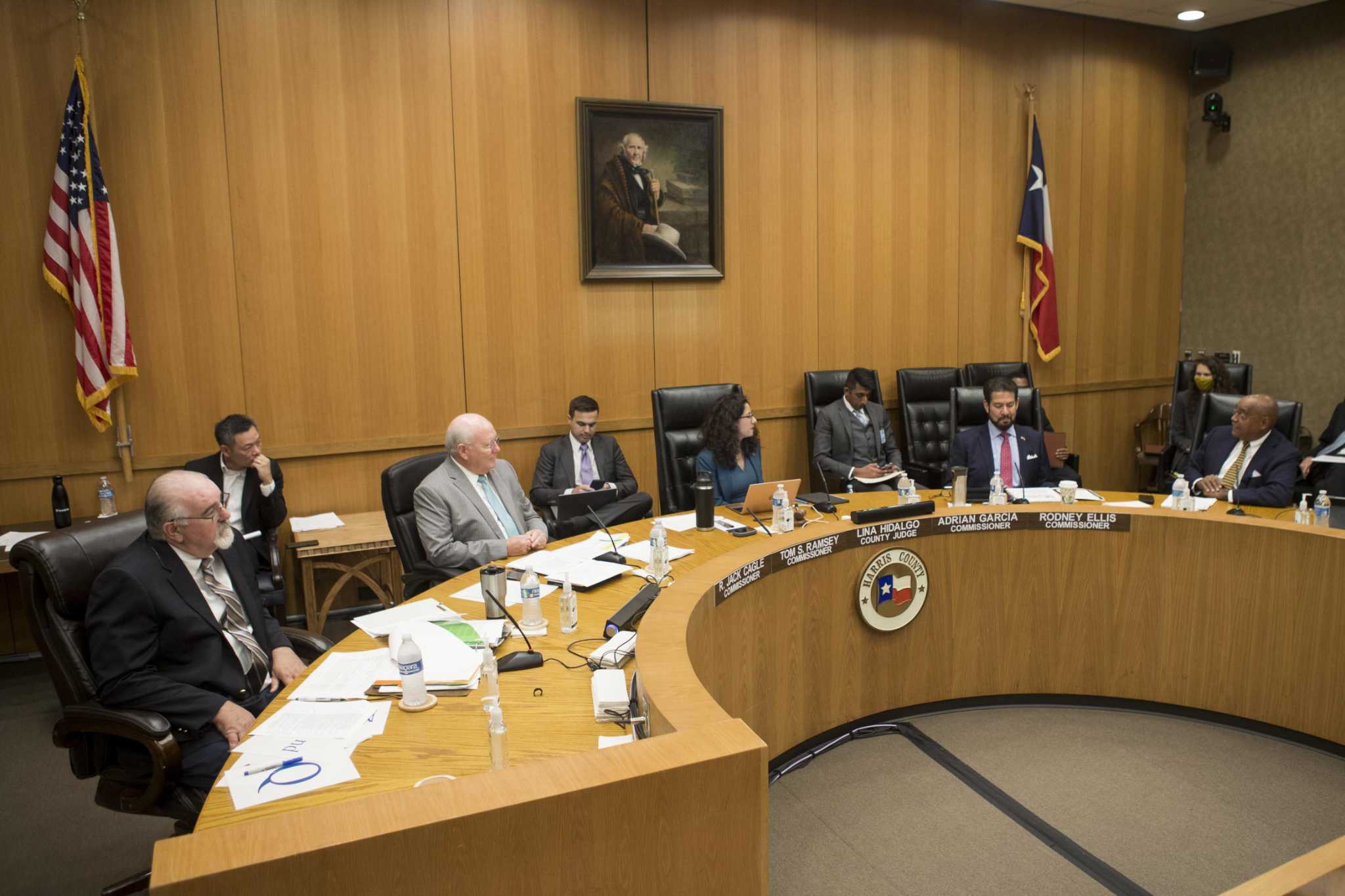

Hill Country Village is keeping its property tax rate flat for fiscal year 2022 but with rising property values the city expects to see a slight increase in revenue compared to last. Outstanding Unlimited Tax Debt. Commissioners voted 4-1 Tuesday to advance a proposal that would keep the tax.

The current total local sales tax rate in San Antonio TX is 8250. San Antonios fiscal 2021 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of 250. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the San Antonio Department of Revenue please call 512-463-2731.

2021 Official Tax Rates. Jurors parking at the garage. The minimum combined 2022 sales tax rate for Bexar County Texas is.

San Antonios fiscal 2021 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of 250. 2022-2023 Debt Service Expenditures budgeted. Monday - Friday 745 am - 430 pm Central Time.

San Antonio TX 78283-3966. The December 2020 total local sales tax rate was also 8250. This city can afford to give more back to our.

However the Texas Legislature in 2019. 2021-2022 Debt Service Expenditures estimated 207897436. If San Antonio wants to expand its current homestead exemption City Council must approve such a measure by July 1.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The Texas state sales tax rate is currently. The minimum combined 2022 sales tax rate for San Antonio Texas is.

The sales tax jurisdiction. This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates.

The county opens the budget up for public input at its regular 9 am. Any increase in the operating tax rate which. What is the sales tax rate in San Antonio Texas.

A Look At 2020 And 2021 State Individual Income Tax Rates And Income Brackets Don T Mess With Taxes

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

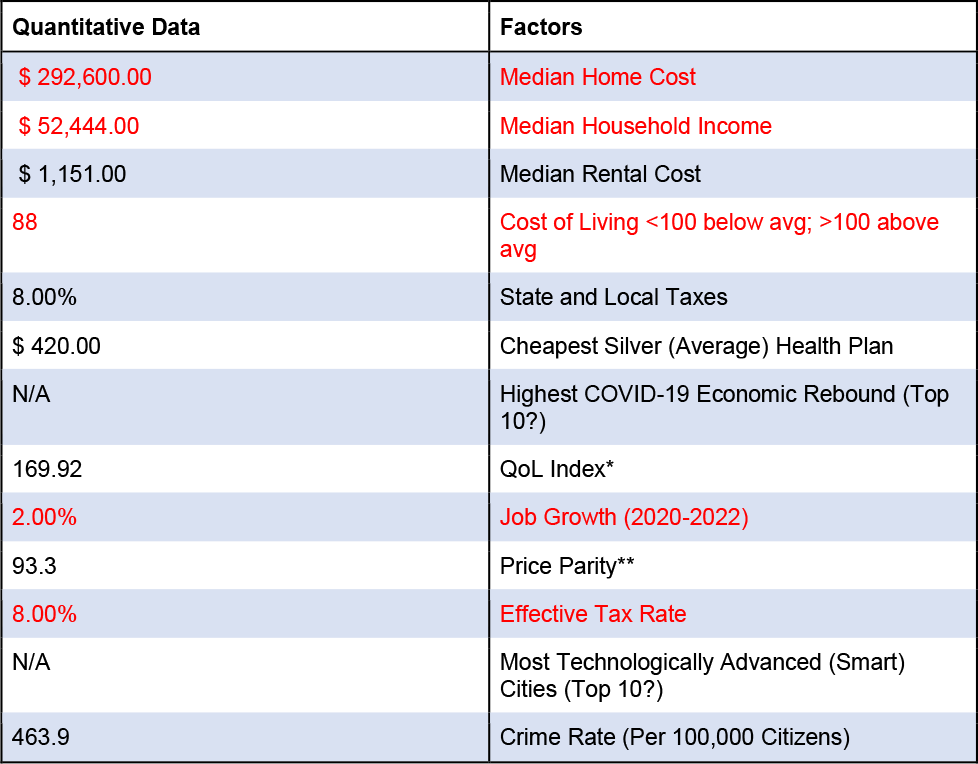

Top 10 Cities For Financial Independence In 2022 Choosefi

Tax Breaks For Developers Under Scrutiny In San Antonio Texas Capitol San Antonio Heron

Most Texans Pay More In Taxes Than Californians Reform Austin

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Budget Tax Notices Converse Tx Official Website

Harris County Inches Ahead On Budget And Tax Rate

Bad Takes Texas May Not Have An Income Tax But Most Residents Pay More Taxes Than Californians Texas News San Antonio San Antonio Current

Perry Courage S Push For Property Tax Relief A No Go For Now

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Niada Convention And Expo August 23 26 San Antonio Texas

Harris County Commissioners Court Approves Lower Overall Tax Rate For Fy 2021 22 Community Impact

U S Cities With The Highest Property Taxes

Travis County Approves Fiscal Year 2021 22 Tax Rate Community Impact

We Ve Been Gentrified Mckee Rodriguez Spurring New Conversation About Gentrification In San Antonio San Antonio Heron

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes