what is bear trap in investing

A bear trap is the opposite of a bull trap. In general a bear trap is a technical.

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The bear trap hits when your stock price rises so far that you no longer have enough margin to cover the current value.

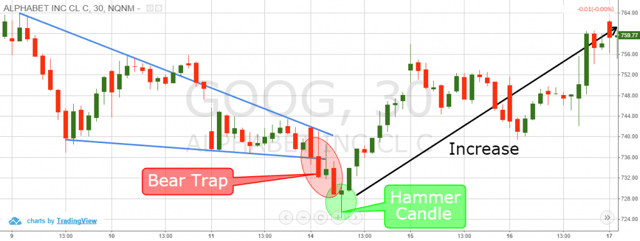

. What is a Bear Trap. So now lets find out what a bear trap is and how it can affect trading. A bear trap is a market situation in which traders expect downward movement to continue after a sudden support breakout but the market changes course.

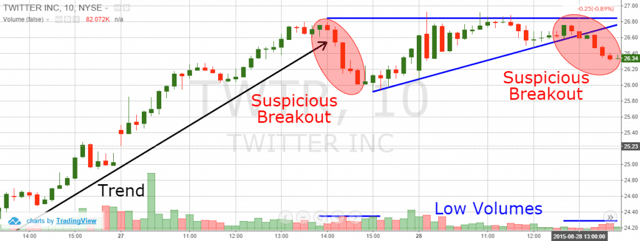

The creation of a bear trap involves the careful planning and execution of a set of circumstances in which there is sense of an impending short term fall in the price of a given. Potential to produce 100 pips plus moves. Bull traps are often associated with short-term rises during a market downturn aka a dead cat bounce but they can also occur during an uptrend a plateau.

Ad Smart Options Strategies shows how to safely trade options on a shoestring budget. See the options trade you can make today with just 270. At that point your broker will issue a margin call and.

Ad Free strategy guide reveals how to start trading options on a shoestring budget. Stop-loss is tight which can allow you. Our Heat Seeker Algorithm Identifies Unusual Activity In The Option Market.

A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. Dont take a short position. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

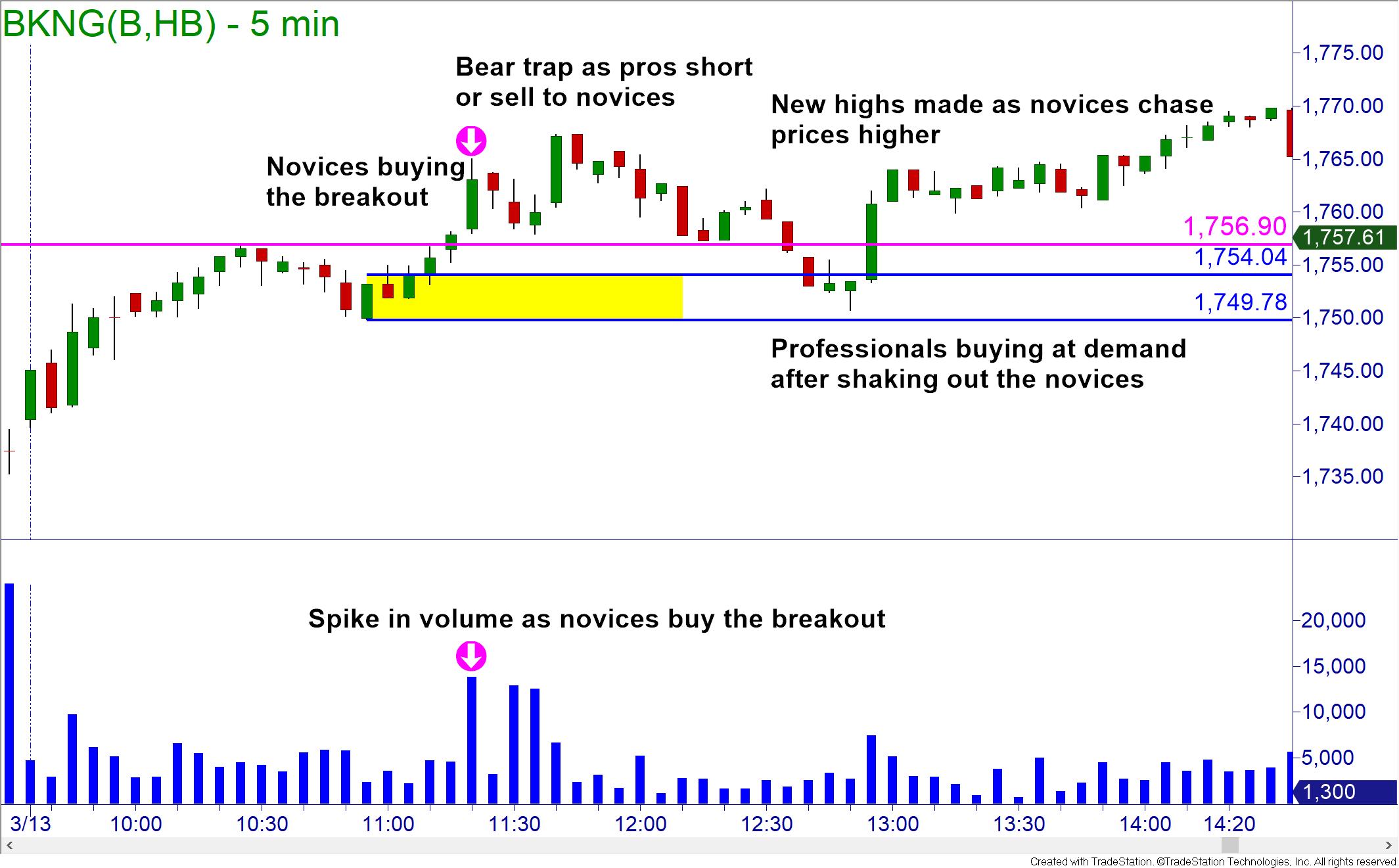

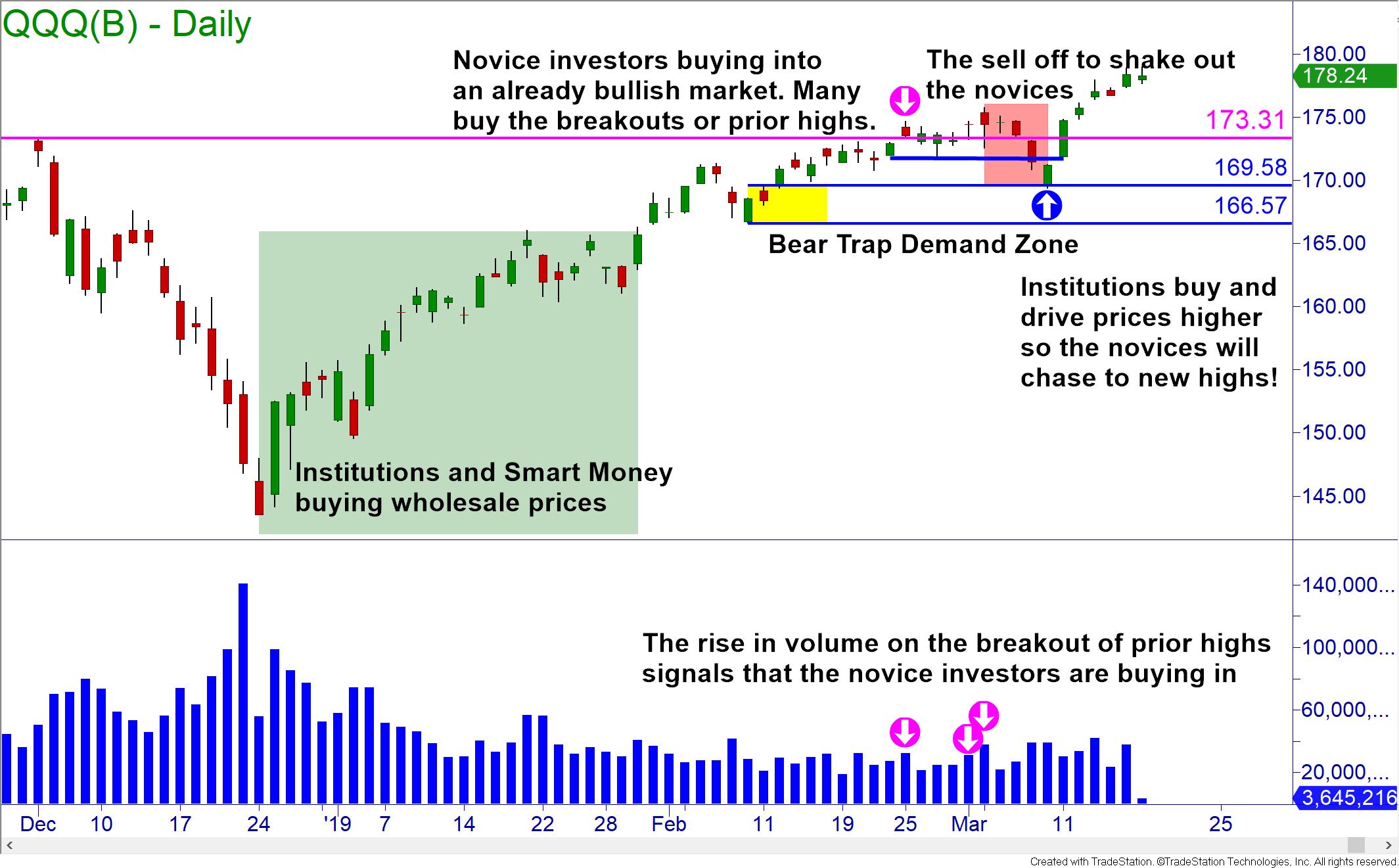

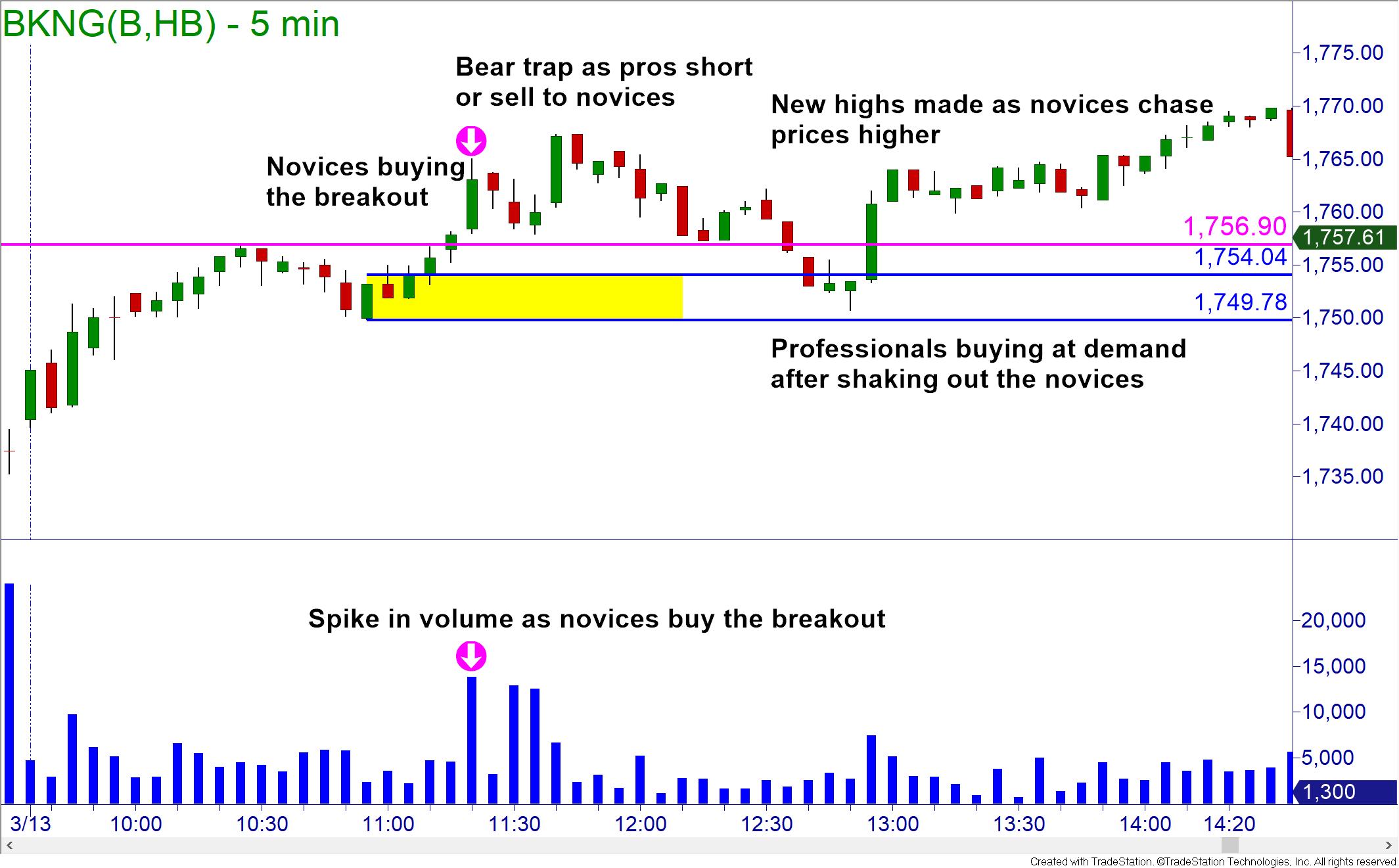

A Bear Trap in terms of trading is a strategy that institutions use to take advantage of the young traders that dont have the insight to recognise when they are being played. A bear trap or bear trap pattern is a sudden downward price movement luring bearish investors to sell an investment short followed by a price reversal back upward. Whether youre a pattern trader or just have a hunch about the trajectory of a stock price its important to understand what a bear trap is as well as how to identify and avoid one.

What is Bear Trap in the Stock Market. To put it simply a bear trap is a fake price drop often orchestrated by a few or more traders to trick other market participants mainly novice investors into selling a particular. Download Smart Options Strategies free today to see how to safely trade options.

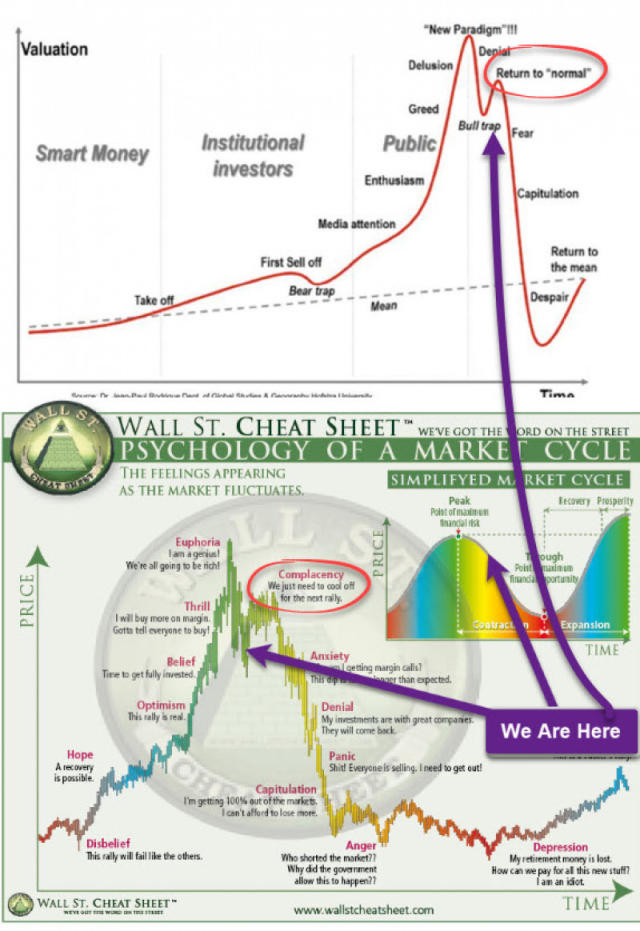

As the name itself suggests a bear trap is basically a situation when forex traders think that a support level is breaking and so as soon as price moves below the support level they start. In the stock market traders depend on technical indicators to help them trade. A bear trap is an investing pattern that happens when a falling security reverses course and begins rising again temporarily or permanently.

Its Our Ownership Structure That Sets Us Apart From The Competition. Ad Use this guide to understand bear markets and what they mean for your financial goals. A bear trap denotes a technical pattern that occurs when the performance of a stock index or other financial instrument incorrectly signals a reversal of a rising price trend.

The simplest way to avoid getting caught in a bear trap is to avoid taking short positions altogether. Advantages of The Bear Trap Pattern Forex Trading Strategy. A bear trap is a condition in the market where the expected downward movement of prices suddenly reverses up.

It is a false indication of a reversal from an uptrend into a downtrend. This pattern incorrectly shows prices reverse to a. A bear trap is a market pattern that occurs when the asset price breaks suddenly below the support level only to reverse immediately.

Selling a stock short is highly speculative and. Ad Unusual Options Activity Trade Ideas From Jon Pete Najarians Team Of Pro Traders. Ad Trusted investment insights since 1921.

A bear trap is a condition with a false signal indicating a strong downtrend momentum when the prices fall steeply but immediately rise with high buying pressure. On May 20 the SP 500 index fell into. We explore what bear traps are and how you can avoid them.

This causes traders to open short positions with expectations of. In order to create more demand and get the prices of stocks to move higher institutions need to shake out the amateurnovice traders. Investors who have bet against.

Bear trap is a financial trap set up by intelligent investors to force small investors to sell their investment assets such as crypto stock or commodity by investors. 98 of readers report taking some type of investment action after reading Barrons. Ad At Vanguard Youre More Than Just An Investor Youre An Owner.

For investors with 500000 get your free guide and ongoing insights.

The Bear Trap Everything You Ve Ever Wanted To Know About It

This Is A Suckers Stock Market Rally

Bear Trap Stock Trading Definition Example How It Works

What Is A Bear Trap On The Stock Market

What Is A Bear Trap In Stock Market Trading Quora

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

What Is A Bear Trap On The Stock Market

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bull Trap In Trading And How To Avoid It Ig En

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The Bear Trap Everything You Ve Ever Wanted To Know About It

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

The Great Bear Trap Bull Trap Seeking Alpha

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)